IN MEMORY of DANIEL DuROSS: Justice Delayed…Is Not Justice Denied.

It’s said that all things come to those who wait and Joan DuRoss is living proof.

It was September 24, 1963, when DuRoss received notification of the worst nightmare that family members of law enforcement officers can possibly face: her husband had been killed in the line of duty. Daniel DuRoss, only 29 years old at the time, had been on patrol near Hartford Avenue in Atlantic City when a drunk driver careened around the corner and struck his motorcycle. An odyssey of grief, hardship and waiting began for Joan DuRoss on that day.

Initially, DuRoss received workers’ compensation benefits, but the laws surrounding such benefits are murky for those not familiar with them and she was one of those people. She and Daniel were already parents when he died and a third child was on the way. As the mother of three little girls, she had her hands full just trying to get by after her husband was taken from her. She accepted the workers compensation checks that came monthly and about 18 years later, when they stopped coming, she accepted that too.

“Between rent, other bills…it was just so hard,” DuRoss said. She had neither the time and energy, nor the resources to find out why the checks stopped coming.

In fact, workers compensation laws were working against her. In 1982, the law mandated that benefits be terminated when the last remaining child of a fallen officer reached the age of 18 if his spouse was employed at the time. DuRoss was employed and her youngest daughter had celebrated her eighteenth birthday. CNA Insurance therefore determined that she was no longer entitled to the payments she had been receiving.

But all that changed in 1995 when several workers compensation laws were revised, including that which provided CNA insurance with blanket protection for terminating DuRoss’s benefits. The insurance company was obligated to contact her and resume sending her checks, but they never did. And without notification from them, DuRoss had no idea that anything had changed.

So she struggled on, trying to make ends meet. She never remarried and when she finally retired she found herself trying to exist on about $700 per month in Social Security Benefits. Her brother, Calvin “Joe” Dooley, helped where he could and finally he reached out to a woman named Madeline Neumann.

Neumann was uniquely qualified to help. She is the co-founder of Garden State Concerns of Police Survivors (C.O.P.S.), the New Jersey chapter of a national organization that helps the surviving families of law enforcement officers killed in the line of duty. A police widow herself with little peer support to help her in her time of grieving, Madeline learned about C.O.P.S. in May 1990 when she received a mailing notifying her of National Police Week to be held in Washington D.C.. There, she met untold others dealing with similar issues. Inspired by the event, Madeline and four fellow survivors decided to start a C.O.P.S. chapter in New Jersey. Garden State C.O.P.S. was eventually founded in 1998.

Whenever there is a line-of-duty death in New Jersey Garden State C.O.P.S. immediately reaches out to let survivors know that there is support available to them. They are active in legal and legislative issues. They didn’t exist in 1982 when her workers compensation benefits were abruptly terminated. But Neumann was ready, willing and able to help when Joe Dooley finally contacted her in 2008.

Neumann said that DuRoss’s situation was, unfortunately, not uncommon.

“Most survivors are too busy trying to raise their children and run their households alone,” she said, leaving them with little time left over to do the legal research and work required to determine whether or not they are being treated fairly by insurance companies.

In short order, Neumann determined that DuRoss had not been treated fairly. She in turn reached out to Peggy Mallen, one of the founders of the 200 Club of Atlantic and Cape May Counties, a nonprofit organization dedicated to providing financial support for the families of police, fire, and rescue personnel who are killed in the line of duty.

Founded locally in 1986, the 200 Club has a storied past tracing back to a Detroit businessman by the name of Bill Packer. When a police officer was shot and killed during a routine call in 1950, he left behind a young wife and a daughter he would never meet, a little girl was born a month later. Packer promptly sat down and penned notes to 100 people in his community, asking each of them to contribute $200 for the benefit of the family that Officer Mellerta had left behind and the original 200 club was born.

Neumann and Mallen agreed that what DuRoss needed was an attorney and they approached Christopher Day of D’Arcy Johnson Day, a full-service litigation firm with offices throughout New Jersey. A former clerk with the Honorable Richard J. Williams and the Atlantic County Bar Association’s Young Lawyer Liaison from 1996 through 1998, Day opened his own law practice in Atlantic City in 2003, concentrating exclusively on workers compensation claims and personal injury matters. In 2008, he merged his practice with D’Arcy Johnson and formed D’Arcy Johnson Day.

Lawyers may have a bum rap in certain circles but Day should never be included in the stereotypes. A longtime member and supporter of the 200 club, he took on DuRoss’s case free of charge.

“When I signed her as a client,” Day said, “I knew that the chances of prevailing against the insurance company were not good. She hadn’t raised the issue of nonpayment for more than 23 years, and normally an individual has two years to raise such an issue in court.”

But Day decided to take the case anyway. “There are certain fights I refuse to walk away from, even if it’s not a good business decision,” Day said. “I couldn’t stand by and allow the insurance company to get away with this.”

In fact, the Joan DuRoss case was one of the first that Day and his new partners took on after the merger and it became the prototype of their dedication to fighting for the underdog. The firm has a real commitment to representing people who are truly in need of help. Cases are evaluated not necessarily on their obvious merits or projected outcome, but on the difference that the attorney’s work will make in their clients lives. One of the things that brought D’Arcy Johnson Day together was their shared desire to use their law licenses for a greater good.

“Chris’s effort here remind us all what being a lawyer is all about,” said Pat D’Arcy, one of Day’s partners. “It’s about giving it everything you have to make a positive difference in someone’s life.”

And in the case of DuRoss, Day really did have to give it all he had. “The challenge was that she no paperwork to back up her claim,” Day said.

Nonetheless, he was able to file a claim petition on her behalf on April 10, 2008, nearly 45 years after Daniel DuRoss’s death and 26 years after her benefits had been terminated. He learned the identity of the insurance company that covered Atlantic City workers in 1963 – CNA, and six months later, he added CNA Insurance to the suit.

Initially, CNA denied that it was responsible for the claim but Day and his team unearthed state documents proving that it was. The company then argued that DuRoss was not entitled to any resumption of benefits because that statute of limitations had expired. Wrong again, Day said, and he proved it too.

In the meantime, New Jersey State Senator James Whelan learned of DuRoss’s plight. In February 2009, he introduced a bill that will remove the statute of limitation for surviving spouses to bring action when workers compensation benefits are wrongly terminated.

Eventually, the insurance company agreed to settle. Day was not only able to secure a lump sum payment for DuRoss’s past due benefits, but he also obtained an order requiring the insurance company to provide her with lifetime benefits – all without asking DuRoss for a dime of the money for his own fees.

DuRoss recalls Day calling her into his office March 6, 2009. When he gave her the news, she was actually surprised. “I just couldn’t believe it.” she said. “I remember thinking that now I feel like a real person again.”

She had her doubts about the outcome of the case at the beginning. “To be honest, so much time had gone by,” DuRoss said. “I just felt that nothing good would happen. I was afraid to get my hopes up too much.”

So if she didn’t have hope, what kept her going throughout the case? DuRoss credits God. “I prayed a lot,” she said, “and that helped. And I had a lot of good people who kept me going: Madeline Neumann, Peggy Mallen, my brother and Christopher. Chris kept in touch with me all the time so I alwys knew what was happening, and that made it easier.

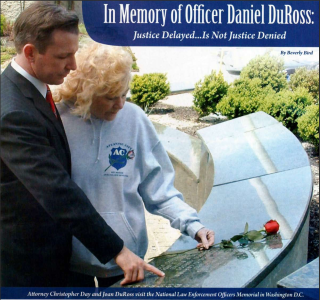

To celebrate, Day and DuRoss want to the Police and Firefighters Plaza in Atlantic City and placed a rose on the monument bearing her late husband’s name. And she recently visited Washington D.C., and saw his name on the National Law Enforcement Officers Memorial for the first time.

“Thanks to Chris Day, she was able to concentrate on honoring her husband, not making ends meet,” Peggy Mallen said.

As for what she plans to do with the proceeds of the settlement, DuRoss exhibits the same patience that has brought her this far.

“I’m just taking it one day at a time,” She said. “I’m still excited and getting used to the idea. I want to be careful.”

By Beverly Bird

Boardwalk Journal – July 2009

It was September 24, 1963, when DuRoss received notification of the worst nightmare that family members of law enforcement officers can possibly face: her husband had been killed in the line of duty. Daniel DuRoss, only 29 years old at the time, had been on patrol near Hartford Avenue in Atlantic City when a drunk driver careened around the corner and struck his motorcycle. An odyssey of grief, hardship and waiting began for Joan DuRoss on that day.

Initially, DuRoss received workers’ compensation benefits, but the laws surrounding such benefits are murky for those not familiar with them and she was one of those people. She and Daniel were already parents when he died and a third child was on the way. As the mother of three little girls, she had her hands full just trying to get by after her husband was taken from her. She accepted the workers compensation checks that came monthly and about 18 years later, when they stopped coming, she accepted that too.

“Between rent, other bills…it was just so hard,” DuRoss said. She had neither the time and energy, nor the resources to find out why the checks stopped coming.

In fact, workers compensation laws were working against her. In 1982, the law mandated that benefits be terminated when the last remaining child of a fallen officer reached the age of 18 if his spouse was employed at the time. DuRoss was employed and her youngest daughter had celebrated her eighteenth birthday. CNA Insurance therefore determined that she was no longer entitled to the payments she had been receiving.

But all that changed in 1995 when several workers compensation laws were revised, including that which provided CNA insurance with blanket protection for terminating DuRoss’s benefits. The insurance company was obligated to contact her and resume sending her checks, but they never did. And without notification from them, DuRoss had no idea that anything had changed.

So she struggled on, trying to make ends meet. She never remarried and when she finally retired she found herself trying to exist on about $700 per month in Social Security Benefits. Her brother, Calvin “Joe” Dooley, helped where he could and finally he reached out to a woman named Madeline Neumann.

Neumann was uniquely qualified to help. She is the co-founder of Garden State Concerns of Police Survivors (C.O.P.S.), the New Jersey chapter of a national organization that helps the surviving families of law enforcement officers killed in the line of duty. A police widow herself with little peer support to help her in her time of grieving, Madeline learned about C.O.P.S. in May 1990 when she received a mailing notifying her of National Police Week to be held in Washington D.C.. There, she met untold others dealing with similar issues. Inspired by the event, Madeline and four fellow survivors decided to start a C.O.P.S. chapter in New Jersey. Garden State C.O.P.S. was eventually founded in 1998.

Whenever there is a line-of-duty death in New Jersey Garden State C.O.P.S. immediately reaches out to let survivors know that there is support available to them. They are active in legal and legislative issues. They didn’t exist in 1982 when her workers compensation benefits were abruptly terminated. But Neumann was ready, willing and able to help when Joe Dooley finally contacted her in 2008.

Neumann said that DuRoss’s situation was, unfortunately, not uncommon.

“Most survivors are too busy trying to raise their children and run their households alone,” she said, leaving them with little time left over to do the legal research and work required to determine whether or not they are being treated fairly by insurance companies.

In short order, Neumann determined that DuRoss had not been treated fairly. She in turn reached out to Peggy Mallen, one of the founders of the 200 Club of Atlantic and Cape May Counties, a nonprofit organization dedicated to providing financial support for the families of police, fire, and rescue personnel who are killed in the line of duty.

Founded locally in 1986, the 200 Club has a storied past tracing back to a Detroit businessman by the name of Bill Packer. When a police officer was shot and killed during a routine call in 1950, he left behind a young wife and a daughter he would never meet, a little girl was born a month later. Packer promptly sat down and penned notes to 100 people in his community, asking each of them to contribute $200 for the benefit of the family that Officer Mellerta had left behind and the original 200 club was born.

Neumann and Mallen agreed that what DuRoss needed was an attorney and they approached Christopher Day of D’Arcy Johnson Day, a full-service litigation firm with offices throughout New Jersey. A former clerk with the Honorable Richard J. Williams and the Atlantic County Bar Association’s Young Lawyer Liaison from 1996 through 1998, Day opened his own law practice in Atlantic City in 2003, concentrating exclusively on workers compensation claims and personal injury matters. In 2008, he merged his practice with D’Arcy Johnson and formed D’Arcy Johnson Day.

Lawyers may have a bum rap in certain circles but Day should never be included in the stereotypes. A longtime member and supporter of the 200 club, he took on DuRoss’s case free of charge.

“When I signed her as a client,” Day said, “I knew that the chances of prevailing against the insurance company were not good. She hadn’t raised the issue of nonpayment for more than 23 years, and normally an individual has two years to raise such an issue in court.”

But Day decided to take the case anyway. “There are certain fights I refuse to walk away from, even if it’s not a good business decision,” Day said. “I couldn’t stand by and allow the insurance company to get away with this.”

In fact, the Joan DuRoss case was one of the first that Day and his new partners took on after the merger and it became the prototype of their dedication to fighting for the underdog. The firm has a real commitment to representing people who are truly in need of help. Cases are evaluated not necessarily on their obvious merits or projected outcome, but on the difference that the attorney’s work will make in their clients lives. One of the things that brought D’Arcy Johnson Day together was their shared desire to use their law licenses for a greater good.

“Chris’s effort here remind us all what being a lawyer is all about,” said Pat D’Arcy, one of Day’s partners. “It’s about giving it everything you have to make a positive difference in someone’s life.”

And in the case of DuRoss, Day really did have to give it all he had. “The challenge was that she no paperwork to back up her claim,” Day said.

Nonetheless, he was able to file a claim petition on her behalf on April 10, 2008, nearly 45 years after Daniel DuRoss’s death and 26 years after her benefits had been terminated. He learned the identity of the insurance company that covered Atlantic City workers in 1963 – CNA, and six months later, he added CNA Insurance to the suit.

Initially, CNA denied that it was responsible for the claim but Day and his team unearthed state documents proving that it was. The company then argued that DuRoss was not entitled to any resumption of benefits because that statute of limitations had expired. Wrong again, Day said, and he proved it too.

In the meantime, New Jersey State Senator James Whelan learned of DuRoss’s plight. In February 2009, he introduced a bill that will remove the statute of limitation for surviving spouses to bring action when workers compensation benefits are wrongly terminated.

Eventually, the insurance company agreed to settle. Day was not only able to secure a lump sum payment for DuRoss’s past due benefits, but he also obtained an order requiring the insurance company to provide her with lifetime benefits – all without asking DuRoss for a dime of the money for his own fees.

DuRoss recalls Day calling her into his office March 6, 2009. When he gave her the news, she was actually surprised. “I just couldn’t believe it.” she said. “I remember thinking that now I feel like a real person again.”

She had her doubts about the outcome of the case at the beginning. “To be honest, so much time had gone by,” DuRoss said. “I just felt that nothing good would happen. I was afraid to get my hopes up too much.”

So if she didn’t have hope, what kept her going throughout the case? DuRoss credits God. “I prayed a lot,” she said, “and that helped. And I had a lot of good people who kept me going: Madeline Neumann, Peggy Mallen, my brother and Christopher. Chris kept in touch with me all the time so I alwys knew what was happening, and that made it easier.

To celebrate, Day and DuRoss want to the Police and Firefighters Plaza in Atlantic City and placed a rose on the monument bearing her late husband’s name. And she recently visited Washington D.C., and saw his name on the National Law Enforcement Officers Memorial for the first time.

“Thanks to Chris Day, she was able to concentrate on honoring her husband, not making ends meet,” Peggy Mallen said.

As for what she plans to do with the proceeds of the settlement, DuRoss exhibits the same patience that has brought her this far.

“I’m just taking it one day at a time,” She said. “I’m still excited and getting used to the idea. I want to be careful.”

By Beverly Bird

Boardwalk Journal – July 2009